|

Payday loan

websites banned

LIVERPOOL City Council is

banning payday loan firms from its IT network to help protect

residents from accumulating high levels of debt. The firms'

websites will be blocked at computers in the City's libraries and

other buildings.

The move comes after new research shows Liverpool people had one of

the biggest average rise in payday loan debt in the last 2 years. In

2012 the average payday loan debt in the City was £1748, an increase

of £463 on the previous year. "It is clear that payday loan companies are targeting the

poorest and most vulnerable people. In the current

economic climate there is a danger that more people resort to

desperate measures, but with payday loans they end up much further in

debt because of the astronomical interest rates, which can be over

4,000%, these companies charge.

As an authority we do not want to promote this sort of unethical

lending so we are stopping public access to their websites.

We know that because of benefit cuts, high levels of unemployment

and fuel poverty many people are facing a real struggle to make ends

meet, but there are better ways of getting help than using payday loans.

Credit unions provide a much more responsible and affordable way of

lending, there are debt counsellors how can provide impartial advice

and people who have difficulties over such matters as Council tax

should come and talk to us about making arrangements to pay.

Above all I would urge people, to think very carefully before taking

out a payday loan and. as a Council, we will be doing what we can to

discourage their use." said Councillor, Paul

Brant, Liverpool's Deputy Mayor.

Cambridge Ward

Conservative Councillor Surgeries

THE next surgery will be

held on Friday, 9 August 2013, from:- 2:00pm to 3:00pm.

Cambridge Ward Conservative Councillor Tony Crabtree will be holding

a surgery on the 2nd Friday of each month at the Crema

Café from

2:00pm to 3:00pm.

The Crema Café is located at 48 Park Road; this is part of Hesketh

Park Shops on the corner of Queens Road and Park Road, Southport.

Tony will be there to meet you and discuss any Council problems you

may have. No appointment necessary; just pop in.

If you prefer, Tony will make arrangements for a home visit and can

be contacted by phone:- (01704) 506 505 or via emailing him

at:-

tony@dolphinman.co.uk

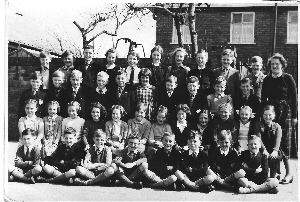

Wrinklies

reunion!

IT has been nearly 60 years

since a group of friends attended St Nicholas C E School,

Blundellsands, but they are now looking forward to meeting more of

their former class mates in a Reunion that is to take place on

6 September 2013.

Said former pupil, Jeanette Smith (nee Compton):- "A few of us

got together and thought it would be a great idea to meet up again

before we all got too old. We are trying to contact as many

ex-pupils as possible to ensure the reunion goes with a bang."

Tickets are already selling well for the event that will take place

at the Hightown Club, Thirlmere Road, Hightown. For further

information contact Jeanette Smith on:- 01704873709. Said former pupil, Jeanette Smith (nee Compton):- "A few of us

got together and thought it would be a great idea to meet up again

before we all got too old. We are trying to contact as many

ex-pupils as possible to ensure the reunion goes with a bang."

Tickets are already selling well for the event that will take place

at the Hightown Club, Thirlmere Road, Hightown. For further

information contact Jeanette Smith on:- 01704873709.

Community

Festival in Birkenhead Park

BIRKENHEAD, on 7

September 2013, will see local musicians and entertainers from

across Merseyside will gather in Birkenhead Park to celebrate the

community of the local area in a free entry fun filled family day of

music, games and food, from 12 noon to 6pm.

The festival will bring together a whole host of bands and

musicians, dancers and performers and a range of activities for kids

including circus skills workshops, fete games and a bouncy castle.

Local crafters and artists will be selling a selection of their

handicrafts and local cafes and bakeries will be selling a range of

tasty treats to take away.

Performers will include Insanity Beach, Firefly, The Beathovens,

Purple Suspect, The Essence, Funkstar Dance, Kathak Bollywood

dancers.

Thanks to People First, Magenta Living, Printing.com and The Big

Lottery for helping to make the festival the best it can be.

For more information on the festival, organised by Options for

Supported Living, go to:-

options-empowers.org.

Letter to Editor:- "Help for

information on The Darlwin pleasure boat accident."

"I am writing a book on the tragic loss of The

Darlwin pleasure boat off Cornwall on 31 July 1966. 29 passengers

and 2 crew were lost with the boat and although a few bodies were

found the final resting place of The Darlwin has never been known.

Sadly some people from your area were victims and I am trying to

contact relatives to include something about them in the book. I'd

be grateful if you could carry this appeal in your paper. If

relatives of the following would contact me:- Mr Raymond Mills, his

son David and daughter Janet of Hartley Crescent, Birkdale,

Southport. Also Mr Albert Russell and his wife Peggy and their son

John and daughter, Patricia of Rider Crescent, Hillside, Southport.

My email is

m_banks@talk21.com." Martin Banks. |

|

7 in 10 people

in North West want bankers charged for PPI mis-selling

SOME 69% of people in the

North West believe that banking executives involved in the mis-selling

of payment protection insurance (PPI) should face criminal charges,

a new survey has revealed.

The study, commissioned by leading PPI claims lawyers Forbes

Douglas, also found that 61% of people in the North West want the

Government to force banks to actively track down and compensate

those who have been mis-sold PPI before any complaints have to be

made. That is slightly lower than the national figure of 62%.

The survey also showed that 65% of those in the North West believe

that the living relatives of deceased victims of PPI mis-selling

should receive the money that banks made from the controversial

practice. However, 18% of people in the region said that determining

who is entitled to get money back in these cases is too difficult

and instead any compensation should be given to charity.

Over £15billion has been set aside by the main UK lenders to settle

claims over mis-sold PPI policies, which are intended to insure

repayment of loans if circumstances prevent the policy holder from

earning the income to service the debt. Barclays this week added

£1.35billion to the £2.6billion it had already put aside to settle

PPI claims.

PPI Policies often have exclusions and in 2011 the High Court ruled

that companies should write to customers most at risk and invite

them to claim.

The total value of unclaimed PPI policies mis-sold to people in the

North West has been estimated at just under £1.8billion; with over

£660million of that in the Greater Manchester area and £350million

on Merseyside.

The Financial Ombudsman Service (FOS) now receives around 2,000

complaints about PPI per day. Statistics from the FOS have revealed

that PPI complaints accounted for a massive 74% of its workload in

the past year, with the total number of new PPI complaints during

the 3 months from April to June of 2013 hitting 132,000, a

year on year increase of 307%.

The research from Forbes Douglas showed that less than 10% of people

in the North West feel that the banking executives responsible for

the mis-selling of PPI should not face criminal charges, exactly in

line with national sentiment. The overwhelming majority, 69% of

respondents in the North West and 70% across the UK, want to see

charges brought against bank bosses.

Well over half of people in the UK (55%) also believe that claims

previously rejected by banks should be reopened, with 57% of people

in the North West sharing that opinion. Indeed, suspicions about

complaints procedures grew further last month when call centre staff

at Lloyds TSB were revealed to be delaying and rejecting PPI

compensation requests in the hope that disgruntled policy holders

would give up on their claims.

Some four million (58%) of the 6.85 million PPI complaints made

between the start of 2010 and the end of 2012 were upheld by the

banks. Complainants gave up on just under 2.4 million (84%) of the

2.86 million complaints rejected; a statistic made more worrying by

the fact that 64% of complaints brought to the FOS after being

rejected by the banks were actually upheld. These abandoned claims

are worth a combined £4.2billion.

Once rejected by the banks, consumers have 6 months to submit a

complaint to the FOS. The high uphold rate at the FOS indicates that

a large proportion of the rejected claims given up on by

complainants may have been valid and worthy of compensation.

Santander UK upheld 83% of PPI complaints in the three-year period

in question, the most of any major bank, though 53% of claims

rejected by Santander and brought to the FOS were then upheld.

Both nationally and in the North West, just 19% of people surveyed

feel that banks should be allowed to negotiate a legally upheld

deadline of 12 months for claims. Talks between lenders and consumer

groups on similar proposals collapsed in June and negative consumer

sentiment was also evident in the survey, as 66% of people in the

North West and 63% of people across the UK completely dismissed the

idea of banks putting a best before date on claims.

Gary Verschuur, Managing Partner at Forbes Douglas, said:-

"The moral thing for Lloyds or any bank with a similar record to do

is voluntarily to re-open all complaints they rejected in this

period. If they don't, the Financial Conduct Authority should insist

upon it. It's clear that people across the UK feel hoodwinked by

banks over the PPI mis-selling scandal and literally thousands of

individuals are coming forward with new complaints every week.

Our research shows that the majority of people want the responsible

parties to face serious consequences over what has happened and

criminal charges are the order of the day, but ensuring that people

who have been wronged by banks are adequately compensated is just as

important. If your claim is rejected by the Financial

Ombudsman, that's the end of the line. However, we can help people

get the compensation they deserve. Going through our

professional and sympathetic PPI Refund Team at Forbes Douglas 1st

could ensure a better result."

The study found that men have slightly less sympathy for banking

executives involved in the PPI scandal. Some 75% of males surveyed

feel that bankers should face charges, compared to 65% of women who

feel the same.

The generational gap is similarly spaced. Some 64% of the youngest

people surveyed, those aged:- 18 to 24, feel that the bankers responsible

should face criminal charges, while 75% of people aged 55 or older

registered the same sentiment.

People in London (63%) and Yorkshire and the Humber (63%) were found

to be the least insistent on criminal charges being brought against

bankers who mis-sold PPI, while those in Scotland (81%) and the

North East (78%) are the most adamant that they should face charges.

Their are also other groups who do PPI work, like

Fast Track Reclaim, so also shop around for the best deals when

looking for help in claiming back your PPI! |