|

Southport Police

reunite New Zearland family with long lost war medals

Photographs thanks to

Merseyside Police

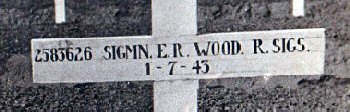

POLICE in Southport have

reunited war medals belonging to a local soldier with his surviving

family 12,000 miles away in New Zealand! Evidence review officer

Dave Cooke turned detective to track down the relatives of former

Marshside resident William Wood after finding them during an audit

of recovered property at Southport Police Station. The medals, which

include a France and Germany Star, had been taken for safe keeping

by officers attending Mr Wood's home in Coyford Drive when he passed

away in non-suspicious circumstances, on 22 September 2004. But his

family did not even know the medals and other wartime treasures

existed, so when they came over from New Zealand to clear Mr Wood's

home they returned to Wellington without them. Now Dave's family is

set to reunite the medals as well as photographs, letters and

jewellery with the family just in time for Christmas having turned

sleuth and tracked them down with the help of Police Officers in

Wellington.

Dave, who got his first lead after

seeing a New Zealand address on the back of a blank cheque found

amongst Mr Wood's property, said:- "I thought it would be a

long shot, but I took the chance that someone might know his next of

kin, so emailed the local Police Station in Mount Victoria with my

tentative enquiry, never expecting I'd get anything back. To my

amazement I got a reply the next day from a Fraser Simpson, a

property clerk who turned out to know William Wood Jnr as a personal

friend! We were put in touch with each other and I had the pleasure

of telling him what we had found and how we'd like to get it all

back to him. The weekend before I had visited the poppies at the

Tower of London with my son and had explained that each one

represented the life of someone who had died in one of the wars. We

had both been incredibly moved by the bravery of the soldiers and

the tragic waste of life that wars bring so I knew how important

these medals would be to someone out there. Now my priority is to

make sure they go in the post in time to get to New Zealand for

Christmas. Sometimes you get a positive result if you put that

little bit of extra effort in but the coincidences have certainly

combined to help too!"

In another strange twist, Mr Wood

used to live at the current home of address of Dave's Mum, in

Southport. William Junior couldn't believe it when Dave told him

about it after they starting emailing each other. He said:-

"My first reaction was 'Wow!', then the more I read Dave's email

several times the stranger it became. Dave's email to Wellington

Police went pretty much straight to a friend of mine who obviously

clicked that it was probably me he was after. Then to find that

Dave's mother was living at Fylde Road where my parents lived some

years ago was uncanny! My brother and I just kept on wondering what

other coincidences would turn up! We are very grateful indeed to

Dave and his colleagues at Merseyside Police for taking the trouble

to find me and it proves that sometimes playing a long shot pays

off. I already have my grandfather's World War One medals and always

intended to mount them in a frame. Now, thanks to Dave, I can do

that and mark our family's total contribution and sacrifice in both

World Wars."

Dave meanwhile is looking forward

to playing Santa and posting the treasures via recorded delivery to

ensure they cover the 12,000 mile journey in ample time for

Christmas. David said:- "I'll definitely keep in touch with

Will and hope to be able to see a photo of the framed medals of his

dad, uncle and grandfather, all together on his wall in New Zealand.

It will be a satisfying end to a really rewarding little

investigation." |

|

HMRC's Christmas

Online Shopping Goods Tax Warning

CHRISTMAS shoppers looking

for bargains overseas have been warned by HM Revenue and Customs (HMRC)

not to get hit by unexpected charges.

Shoppers buying goods online from

non-European Union (EU) countries, or travellers going abroad to do

Christmas shopping, are advised to check how much they can buy

before customs duty or import VAT are due.

HMRC's Head of Customs Policy,

Angela Shephard, said:- "We know many people like to go abroad

at this time to buy their Christmas gifts, or buy online from non-EU

countries, and think that the 'cheaper' price they see is always the

price they finally pay. We want to remind everyone how much they can

actually bring back from abroad or buy from an online overseas

seller without having to pay customs duty or import VAT. Shoppers

must always be cautious with websites that say they will undervalue

your goods so you won't pay VAT or offer famous 'brand' names at

very low prices. HMRC knows about these sites and people who think

they've found a bargain may actually end up paying more or having

goods seized."

Quick notes:-

1. If you buy goods over the internet or by mail order from outside

the EU, you will have to pay VAT if the value of the package is over

£15. In this case, VAT will be calculated on the full item value,

not just the value above the allowance.

2. Since 1 April 2012, all mail order imports from the Channel

Islands are subject to VAT, regardless of their value.

3. If someone sends you a gift from outside the EU, import VAT will

only be due if the package is valued at over £36. To qualify as a

gift, the item must be sent from one private individual to another,

with no money changing hands. If the value exceeds £36, VAT will be

calculated on the full item value, not just the value above the

allowance.

4. If the goods are over £135 in value, customs duty may also be

due, although this will depend on what they are and where they have

been sent from. Where the actual amount of duty due is less than £9,

this will not be charged.

5. Excise duty is always due on all alcohol and tobacco products

purchased online or by mail order.

6. Arriving in the UK by commercial sea or air transport from a

non-EU country, you can bring in up to £390 worth of goods for

personal use without paying customs duty or VAT (excluding tobacco

and alcohol, which have separate allowances). Arriving by other

means, including by private plane or boat for pleasure purposes, you

can bring in goods up to the value of £270. Above these allowances

and up to £630, there is a duty flat rate of 2.5%.

7. Detailed information on the non-EU limits for alcohol and tobacco

products can be found on HMRC's

website.

8. If you are thinking of going across the Channel to replenish

beers, wines, spirits or tobacco products, there are no limits on

the amounts of duty and tax paid goods you can bring back personally

from another EU country, as long as they are for your own use. You

may, however, be asked questions at the UK border if you have more

than:-

► 110 litres of beer.

► 90 litres of wine.

► 10 litres of spirits.

► 20 litres of fortified wines.

► 800 cigarettes.

► 200 cigars.

► 400 cigarillos

► 1kg of tobacco

This is to establish these quantities are genuinely for your own

use.

9. The duty free limits for imports of alcohol and tobacco products

from outside the EU are:-

Alcohol

allowances

You can bring in either, but not

both, of the following:-

► 1 litre of spirits or strong liqueurs over 22% volume.

► 2 litres of fortified wine (such as port or sherry), sparkling

wine or any other alcoholic drink that is less than 22% volume

Or you can combine these allowances. For example, if you bring in

one litre of fortified wine (half your full allowance) you can also

bring in half a litre of spirits (half your full allowance). This

would make up your full allowance and you can't go over your total

alcohol allowance.

In addition you may also bring back both of the following:-

► 16 litres of beer.

► 4 litres of still wine.

Tobacco

allowances

You can bring in 1 from the

following list:-

► 200 cigarettes.

► 100 cigarillos.

► 50 cigars.

► 250g of tobacco.

Or you can combine these allowances. For example, if you bring in

100 cigarettes (half your full allowance) you can also bring in 25

cigars (half your full allowance). This would make up your full

tobacco allowance. You can't go over your total tobacco allowance.

You cannot

combine alcohol and tobacco allowances

10. When travelling to the UK from

outside the EU, if you bring in any single item worth more than the

£390 goods allowance (£270 if arriving by other means, including

private plane or boat for pleasure purposes), you must pay duty

and/or tax on the full item value, not just the value above the

allowance. You also cannot group individual allowances together to

bring in an item worth more than the limit.

11. Further information on postal imports and travellers allowances

can be found

online.

12. Individuals under the age of 17 are not entitled to any alcohol

or tobacco allowances.

|